Decaying isotopes of hydrogen have just given us the smallest measurement yet of the mass of a neutrino.

By measuring the energy distribution of electrons released during the beta decay of tritium, physicists have determined that the upper limit for the mass of the electron antineutrino is just 0.8 electronvolts. That’s 1.6 × 10–36 kilograms in metric mass, and very, very freaking small in imperial.

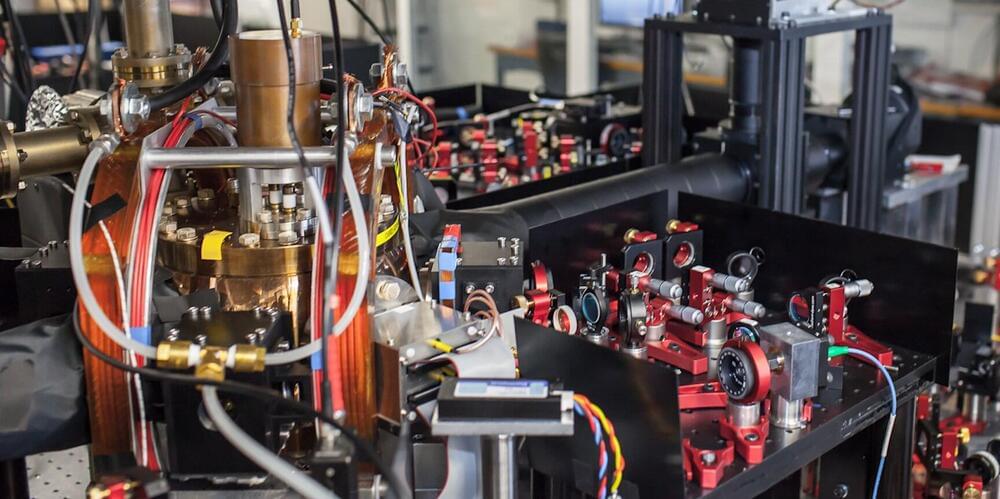

Although we still don’t have a precise measurement, narrowing it down brings us closer to understanding these strange particles, the role they play in the Universe, and the impact they could have on our current theories of physics. The achievement was made at the Karlsruhe Tritium Neutrino Experiment (KATRIN) in Germany.