While topline results from TRAILBLAZER-ALZ showed a 32% slowing of cognitive decline with the anti-amyloid drug donanemab, highly anticipated phase 2 findings provide a more detailed analysis.

Summary: Study identified 300 “hub genes” that appear to control separate gene networks in brain tissue samples. The SAMD3 gene appears to be a master regulator to control the activity of many of the gene hubs and the genes the hubs control.

Source: UT Southwestern Medical Center.

UT Southwestern scientists have identified key genes involved in brain waves that are pivotal for encoding memories. The findings, published online this week in Nature Neuroscience, could eventually be used to develop novel therapies for people with memory loss disorders such as Alzheimer’s disease and other forms of dementia.

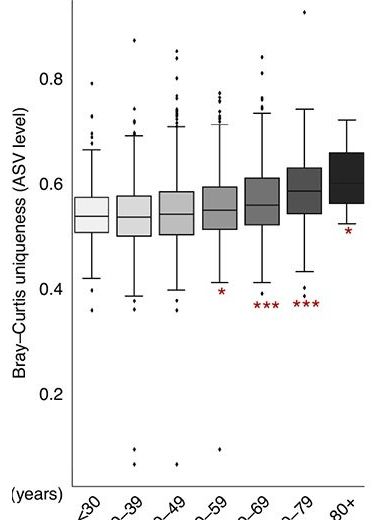

“This is a fascinating study of gut microbiome in older adulthood,” wrote Barbara Bendlin from the University of Wisconsin, Madison. “While the investigators did not look at brain health or cognitive outcomes, it’s interesting to see that they found that healthy aging was accompanied by gut microbiomes that became increasingly more unique to each person starting in middle age. This type of divergence is also observed in brain aging.” (Full comment below.)

Past studies have shown that the gut microbiome undergoes rapid changes in the first three years of life, followed by a longer period of relative stability, then more change once again in later years (Yatsunenko et al., 2012; O’Toole and Jeffery, 2015). Research has also found that centenarians have fewer of the gut microbes commonly seen in younger, healthy people. Instead, they live with an increasingly rarefied microbiota (Kim et al., 2019). This suggests that gut microbiomes become increasingly personalized as people get older, but little is known about how these gut profiles affect the aging process or longevity.

To find out, first author Tomasz Wilmanski and colleagues analyzed gut microbiomes, personal traits, and clinical data from more than 9000 people 18 to 101 years old. They came from three independent cohorts. One was a group of 3653 people aged 18 to 87 who had signed up with Arivale, a now-defunct scientific wellness company co-founded by systems biology pioneer Leroy Hood and Price. Arivale provided personalized wellness coaching by collecting and analyzing data on participants’ genomes and other systems, including their gut microbiomes. Hood founded the Institute for Systems Biology.

Amy Corzine.

Utter waste of time. Trees do it already. We simply need more trees. For our physical and mental health.

1 Reply.

Bieke Cannaerts.

NOOOOOOooo!!! “Leave” nature alone!!!

View 13 more comments.

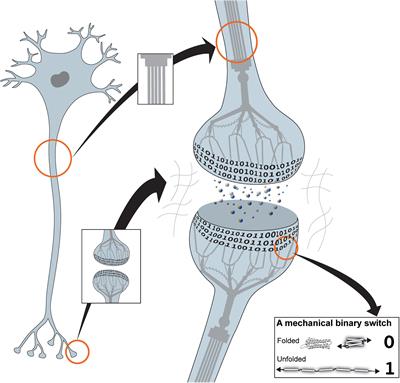

One of the major unsolved mysteries of biological science concerns the question of where and in what form information is stored in the brain. I propose that memory is stored in the brain in a mechanically encoded binary format written into the conformations of proteins found in the cell-extracellular matrix (ECM) adhesions that organise each and every synapse. The MeshCODE framework outlined here represents a unifying theory of data storage in animals, providing read-write storage of both dynamic and persistent information in a binary format. Mechanosensitive proteins that contain force-dependent switches can store information persistently, which can be written or updated using small changes in mechanical force. These mechanosensitive proteins, such as talin, scaffold each synapse, creating a meshwork of switches that together form a code, the so-called MeshCODE. Large signalling complexes assemble on these scaffolds as a function of the switch patterns and these complexes would both stabilise the patterns and coordinate synaptic regulators to dynamically tune synaptic activity. Synaptic transmission and action potential spike trains would operate the cytoskeletal machinery to write and update the synaptic MeshCODEs, thereby propagating this coding throughout the organism. Based on established biophysical principles, such a mechanical basis for memory would provide a physical location for data storage in the brain, with the binary patterns, encoded in the information-storing mechanosensitive molecules in the synaptic scaffolds, and the complexes that form on them, representing the physical location of engrams. Furthermore, the conversion and storage of sensory and temporal inputs into a binary format would constitute an addressable read-write memory system, supporting the view of the mind as an organic supercomputer.

I would like to propose here a unifying theory of rewritable data storage in animals. This theory is based around the realisation that mechanosensitive proteins, which contain force-dependent binary switches, can store information persistently in a binary format, with the information stored in each molecule able to be written and/or updated via small changes in mechanical force. The protein talin contains 13 of these switches (Yao et al., 2016; Goult et al., 2018; Wang et al., 2019), and, as I argue here, it is my assertion that talin is the memory molecule of animals. These mechanosensitive proteins scaffold each and every synapse (Kilinc, 2018; Lilja and Ivaska, 2018; Dourlen et al., 2019) and have been considered mainly structural. However, these synaptic scaffolds also represent a meshwork of binary switches that I propose form a code, the so-called MeshCODE.

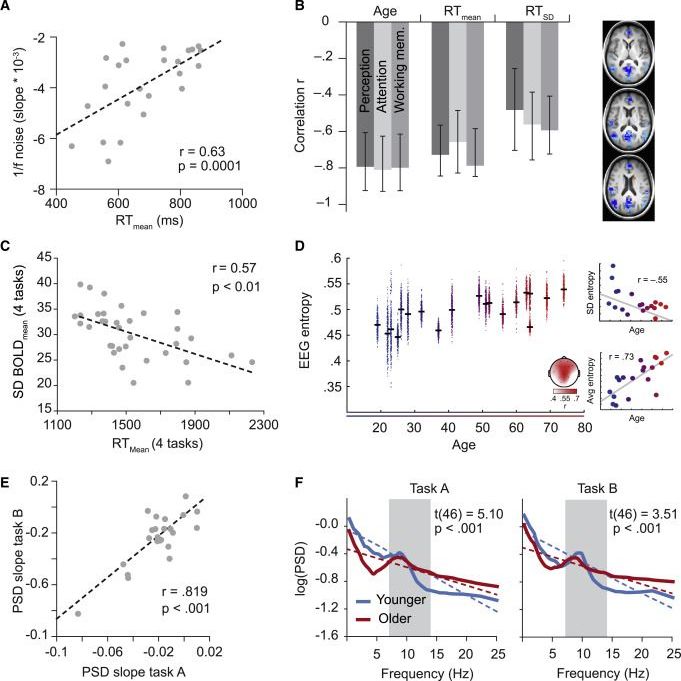

Human and non-human animal behavior is highly malleable and adapts successfully to internal and external demands. Such behavioral success stands in striking contrast to the apparent instability in neural activity (i.e., variability) from which it arises. Here, we summon the considerable evidence across scales, species, and imaging modalities that neural variability represents a key, undervalued dimension for understanding brain-behavior relationships at inter-and intra-individual levels. We believe that only by incorporating a specific focus on variability will the neural foundation of behavior be comprehensively understood.

Have you ever heard of “Allostatic Load” and “Operator Syndrome?”

I stumbled across the work of Christopher Frueh while doing some research on physiological, psychological and hormonal stress mitigation. Frueh, along with his team of researchers, psychologists and former SOF operators, has been exploring the human mind, defining PTSD and outlining Special Operator’s Syndrome. This is one of the only programs in the country specifically designed to help those suffering from this condition.

“Allostatic load” is the cost on your body of chronic stress and physical demands of a career with the military special forces, according to Science Direct. The military recipe for “burning the candle at both ends” includes high intensity physical fitness training, the high stress of operations and being away from home, the trauma of witnessing death, war or injury. Add in the inability to sleep or eat well, and the operator limits the two main recovery responses, which leads to chronic stress. This adds up to Allostatic Overload.

A study of a guaranteed income program in Stockton, California, found that after receiving an extra $500 in cash each month for a year, recipients had better job prospects and improved mental health.

As part of the Stockton Economic Empowerment Demonstration (SEED) pilot program, 125 people in the California city received $500 per month for 24 months starting in February 2019. The program, initiated by former Mayor Michael Tubbs, chose recipients in neighborhoods at or below the city’s median household income of $46033. The money, in prepaid debit cards, was unconditional, meaning people could spend it as they chose.

A study released Wednesday based on the first year of the project, from February 2019 to February 2020, found that beneficiaries got full-time jobs at over twice the rate of non-recipients, were less anxious and depressed over time, and reported improvements in emotional health, well-being and fatigue.

SB Acharyya.

This is correct https://www.frontiersin.org/…/10…/fnhum.2010.00224/

Sesame seed-size brains created from a mix of human and Neanderthal genes lived briefly in petri dishes in a University of California, San Diego laboratory, offering tantalizing clues as to how the organs have evolved over millennia.

Scientists have long wondered how human beings evolved to have such big, complex brains. One way to figure that out is by comparing modern genes involved in brain development with those found in our ancient cousins. Though scientists have found plenty of fossilized remains from Neanderthals — cousins of modern humans that died out about 37000 years ago — they have yet to find a preserved Neanderthal brain. To bridge that gap in knowledge, a research team grew tiny, unconscious “minibrains” in petri dishes. Some of the brains were grown using standard human genes, and others were altered using the gene-editing tool CRISPR to have a brain development gene taken from Neanderthal remains.

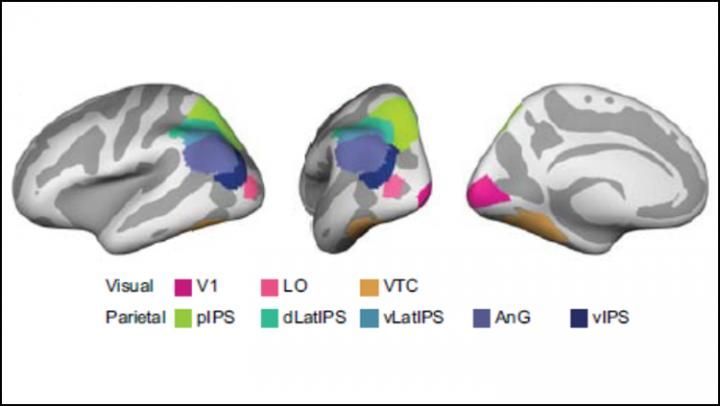

Recently published neuroimaging research provides evidence that the directional connectivity between several brain regions plays an important role in emotional processing abilities.

Although interest in emotional intelligence has been steadily growing since the 1990s, the underlying neural mechanisms behind it have yet to be clearly established. The new study, which appears in NeuroImage, is part of a process to begin to fill in this gap in scientific knowledge.

“Emotional intelligence is one of the least studied topics, especially in conjunction with cutting-edge computational neuroimaging techniques,” explained lead researcher Sahil Bajaj, the director of the Multimodal Clinical Neuroimaging Laboratory at Boys Town National Research Hospital.