Dozens of companies use smartphone locations to help advertisers and even hedge funds. They say it’s anonymous, but the data shows how personal it is.

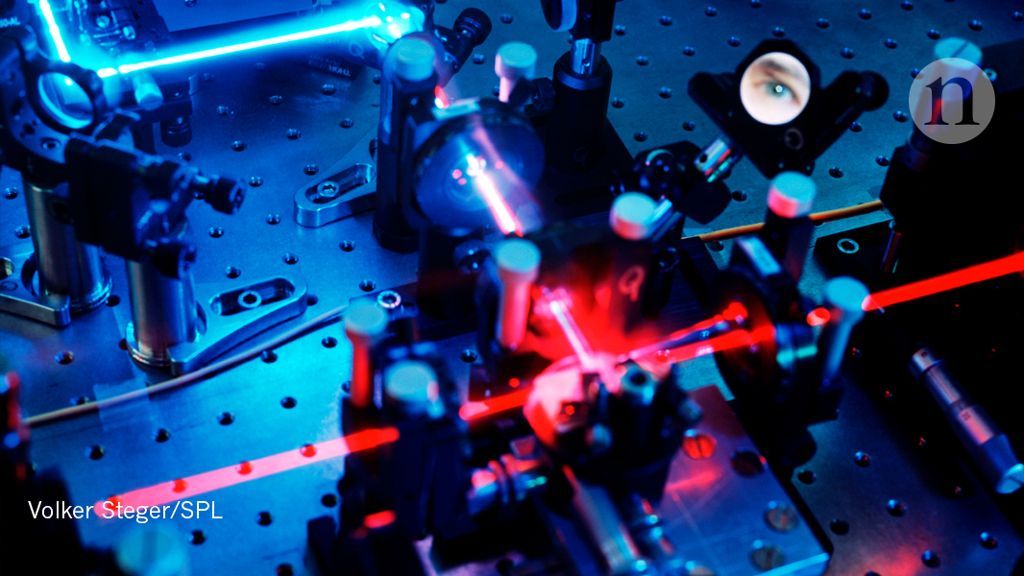

The longer-term answer is to develop and scale up the quantum communication network and, subsequently, the quantum internet. This will take major investments from governments. However, countries will benefit from the greater security offered13. For example, Canada keeps its census data secret for 92 years, a term that only quantum cryptography can assure. Government agencies could use quantum-secured blockchain platforms to protect citizens’ personal financial and health data. Countries leading major research efforts in quantum technologies, such as China, the United States and members of the European Union, will be among the early adopters. They should invest immediately in research. Blockchains should be a case study for Europe’s Quantum Key Distribution Testbed programme, for example.

Bitcoin and other cryptocurrencies will founder unless they integrate quantum technologies, warn Aleksey K. Fedorov, Evgeniy O. Kiktenko and Alexander I. Lvovsky. Bitcoin and other cryptocurrencies will founder unless they integrate quantum technologies, warn Aleksey K. Fedorov, Evgeniy O. Kiktenko and Alexander I. Lvovsky.

Space, Oceans, Literature, Entertainment, Sports, Medicine, Fashion, Longevity — Honored to be among this group of thinkers, coming up with the innovative ideas that shape the future — http://radioideaxme.com

PlayStation users will now see an extra 9 percent tax applied to some purchases on the platform.

Sony has agreed to comply with Chicago’s amusement tax, leaving PlayStation users to face an extra 9 percent tax on streaming and rental services, effective Nov. 14. This latest expansion of the city’s amusement tax will apply to purchases such as rentals, but not full sales of games.

The city’s amusement tax used to mostly apply to purchases of concert and sporting event tickets. However, the Chicago Department of Finance ruled in 2015 that the tax covered streaming services such as Netflix, Hulu and Spotify. This expansion of the amusement tax is commonly dubbed the “Netflix tax” or the “cloud tax.” In addition to being regressive, it is also likely illegal.

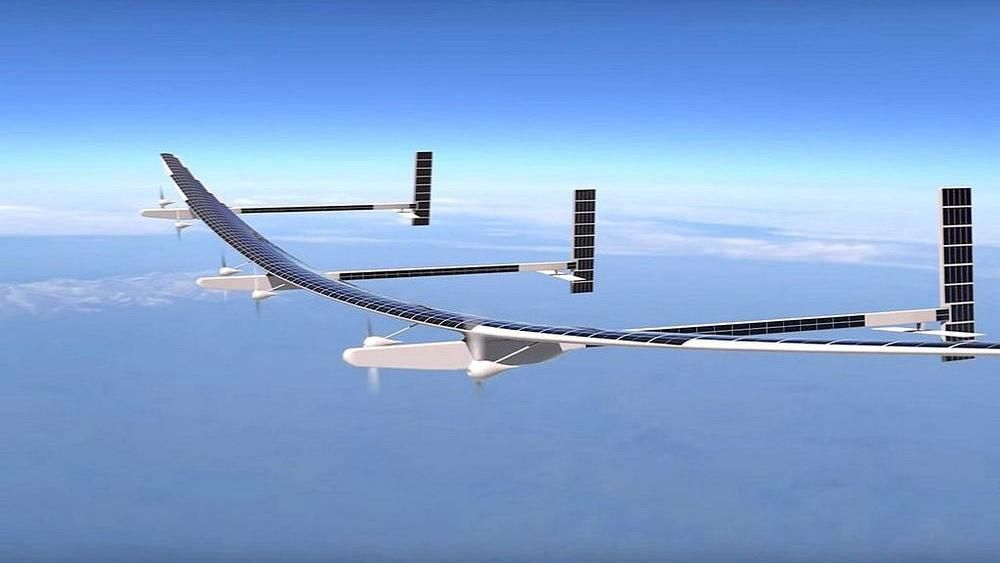

More than an ordinary aerial drone but not quite a satellite, a huge solar-powered airplane with three tails and wings wider than a jumbo jet’s will soon be taking to the skies.

Odysseus, developed by Boeing subsidiary Aurora Flight Sciences of Manassas, Virginia, is one of the largest unpiloted aircraft ever built — and one of the lightest. It has a 243-foot wingspan but weighs less than a small car, the company says. Its six electrically powered propellers will be driven by energy from hundreds of solar panels that cover the aircraft’s exterior or from banks of rechargeable batteries on board, depending on the available sunlight.

With a top speed of 100 miles an hour, Odysseus won’t be very fast. But it’s designed to soar to altitudes above 60,000 feet and stay aloft for months at a time.

Prime Minister Narendra Modi’s administration now is pivoting toward promoting EVs in public transportation and fleet operations – primarily, two- and three-wheelers, taxis and buses. The Ministry of Finance is finalizing a plan to spend about 40 billion rupees ($600 million) in the next five years to improve the nation’s charging infrastructure and subsidize e-buses.

An electric-vehicle revolution is gaining ground in India, and it has nothing to do with cars.

The South Asian nation is home to about 1.5 million battery-powered, three-wheeled rickshaws – a fleet bigger than the total number of electric passenger cars sold in China since 2011. But while the world’s largest auto market dangled significant subsidies to encourage purchases of battery-powered cars, India’s e-movement hardly got a hand from the state.

Rather, drivers of the ubiquitous three-wheelers weaving through crowded, smoggy streets discovered that e-rickshaws are quieter, faster, cleaner and cheaper to maintain than a traditional auto rickshaw. They also are less strenuous than cycle rickshaws, which require all-day peddling. So with more rides possible in a day, the e-rickshaws are proving more lucrative.