In a world increasingly driven by industries that rely on advanced technical learning and innovation, fluency in STEM fields (science, technology, engineering and math) becomes more vital every day. Yet our education system isn’t keeping up. Five years ago, a Business-Higher Education Forum study found that 80% of high school students either lacked interest or proficiency in STEM subjects. Meanwhile, a college and career readiness organization known as ACT reported last year that the number of students pursuing STEM careers is growing at less than 1% annually.

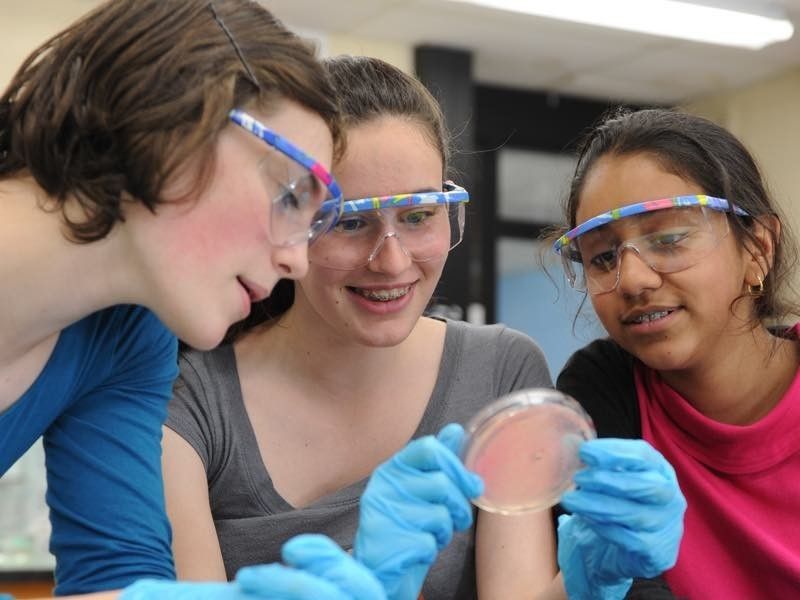

The Amgen Foundation is doing something about it. As the principal philanthropic arm of Amgen, the largest independent biotechnology company, the Amgen Foundation has been committed to inspiring the next generation of scientists and innovators by making immersive science education a focus of its social investments for almost 30 years. While Amgen has reached millions of patients around the world with biotechnology medicines to combat serious illnesses, such as cardiovascular disease, cancer and migraines, the Amgen Foundation has reached more than 4 million students globally—and it is poised to launch a new program called LabXchange with the potential to reach millions more.

“As a scientist, it’s clear to me that the most effective way to learn science is by doing it,” says David Reese, executive vice president of Research and Development at Amgen and member of the Amgen Foundation board of directors. “It’s time to transform the science learning experience. We need to move from information acquisition to application and exploration, from students as passive listeners to active participants in the learning process, from teachers as knowledge transmitters to facilitators and coaches.”