Then the 2017 DoD disclosure occurred, directly contradicting the findings in the Condon Report. We realized we had not discovered all there was to discover — not by a long shot.

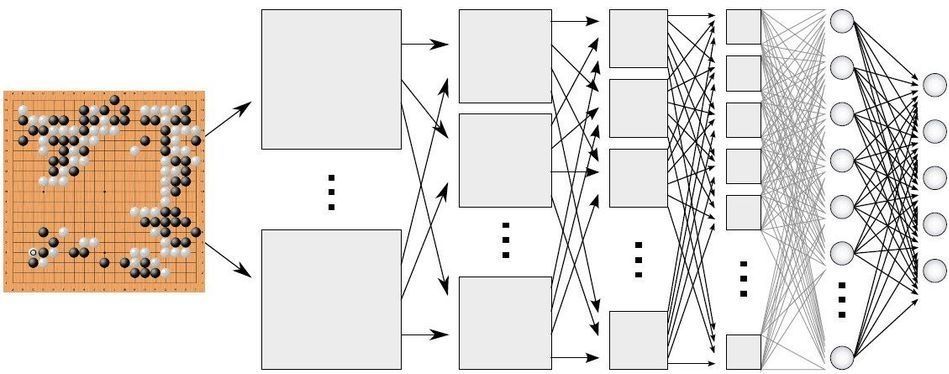

AATIP succeeded where others failed simply because our understanding of the physics finally caught up to our observations.

Today, much of our government’s business is conducted behind closed doors, and mostly for good reason.

There are numerous secret programs, secret agencies, secret committees of Congress, secret laws, and even a secret courtroom. Secrecy allows our government to collect and share information, and even make decisions that otherwise could fall into enemy hands or be exploited.

Ultimately, the purpose of keeping things secret in the government is to protect sources and methods and ensure the flow and integrity of information is maintained so decision-makers can make decisions with the very best data available. It’s no surprise that governments will go to great lengths to protect the information they consider sensitive. In fact, the more sensitive information is perceived, the more it is protected.